Strive ($ASST) and Twenty One ($CEP, $XXI): All the details till now

More and more companies adopting the bitcoin standard

Strive Asset Management

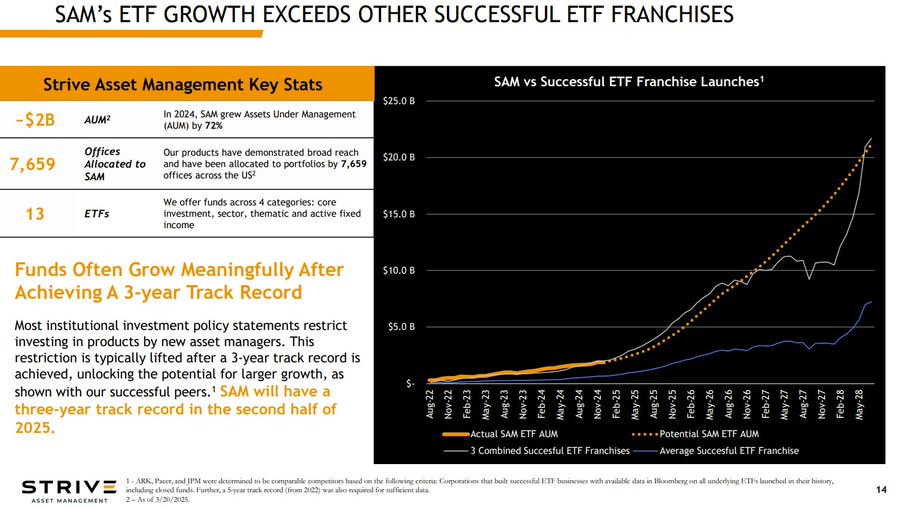

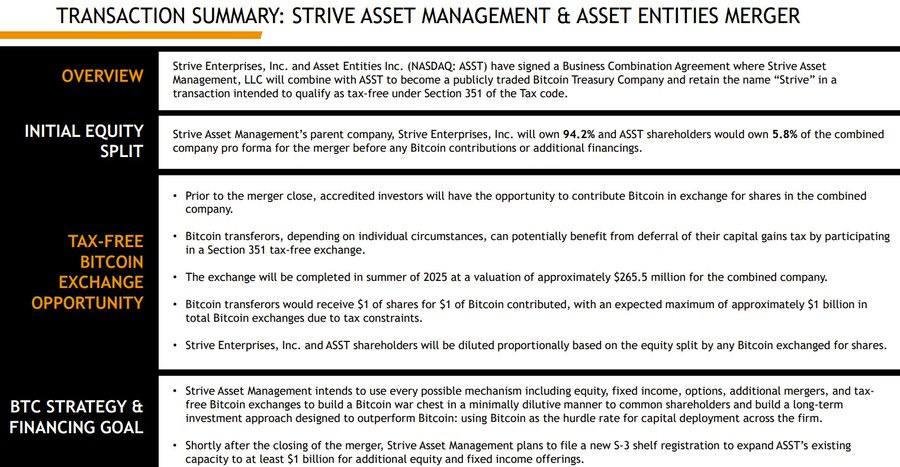

Strive, founded by Vivek Ramaswamy and Matt Cole, announced its bitcoin treasury strategy, through a reverse merger with Asset Entities ASST 0.00%↑. Strive is an asset management company with an AUM of ~$2B. It is based on 3 values - capitalism, meritocracy, and innovation. It wants to maximize shareholder value by building a 'war chest' of bitcoin.

The underlying business - asset manager. ~$2B AUM, with 72% YoY growth. Offers 13 ETFs - both active and passive. Strong growth expected.

Bitcoin treasury operations

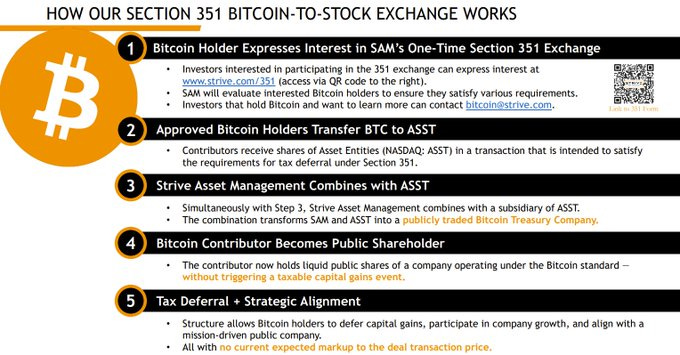

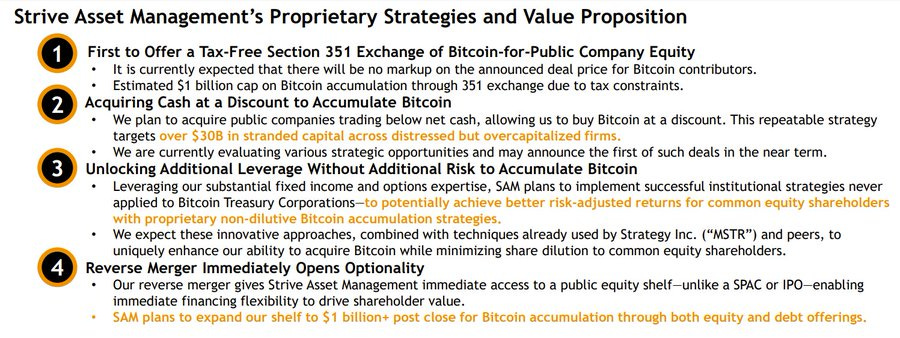

1. Tax-Free Section 351: Exchange of bitcoin for public company equity: Basically swapping your bitcoin for shares in the company. Give Strive $1 of bitcoin, and receive $1 of shares

How this transaction is tax free under US internal revenue code 351: It lets people transfer property (here, Bitcoin) to a corporation solely for stock and defer capital gains tax so long as the transferors (people who gave the bitcoin) control the company (> 80% of vote and value) immediately after the exchange.

So, if the bitcoin transferors control >80% of the vote and value of the company, then this transaction is tax free.

There will be a $1B cap for this transfer. I believe that this limit could be filled - considering that there are a lot of bitcoiners sitting on massive capital gains - and then to sell bitcoin without capital gains tax would be great. But this also brings some short term selling pressure on the stock.

2. Buying companies trading below net cash: Basically buying the dollar for say 90 cents. There is ~$30B to unlock in this strategy. They might even announce a deal before the reverse merger completes. Will be interesting to see where they arrange the initial cash for buying these type of companies - but anyways if they are able to execute this - then this would cause lower dilution

3. Structured finance & options overlays: Matt has experience of managing $70B in fixed income. This would probably include some option plays, and other fixed income strategies.

4. Finally, the $MSTR playbook: ATM, converts, preferred equity, etc. One advantage that Strive will have as this is a reverse merger and not a SPAC (discussed below in the thread), it that it opens the option for immediate ATM - tis is tough for SPACs. They plan to introduce $1B+ of share offerings, using both equity and debt

Summing up, this is a unique bitcoin treasury company - first asset manager to adopt bitcoin as primary treasury asset. They will also have income from the underlying asset management operations to buy more bitcoin

Management

A very experienced team:

Transaction details

This is a reverse merger where ASST shareholders will hold 5.8% and ASST shareholder will own the rest 94.2%

The share price closed at $3.39, giving the company a market cap of $48.87M. This would account for 5.8%, thus giving the company post reverse merger market cap of $843M

On top, there will be bitcoin that will be received from the transferors - this would lead to issuance of additional shares. Say if they raise the complete $1B and the share price remains here - then that would lead to market cap of $1.843B

Advantages of doing a reverse merger instead of going public through a SPAC: they will be able to use the ATM much earlier

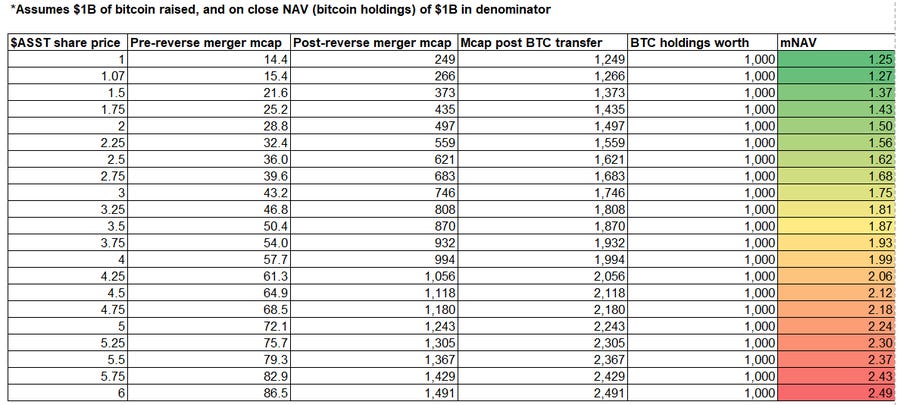

mNAV chart

Rough mNAV calculation, assuming that they raise $1B of bitcoin, and ASST 0.00%↑ accounting for 5.8% of the shares. Methodology:

Take the market cap of ASST 0.00%↑ pre-merger (currently $48.87M) and divide that by 5.8% (brings it $843M)

Then, $1 of shares will be issued for $1 of bitcoin. Thus, if they raise $1B of bitcoin, then that would lead to issuance of $1B of shares, bring the market cap to $1.843B

Assuming that they receive bitcoin at $100K, that would be 10K bitcoin. This is the variable here - at what bitcoin price they receive the transfers

Thus, at market cap of $1.843B, and bitcoin worth $1B, the mNAV stands at 1.843

$1.07 is the deal price ($265.5M valuation). Here is the mNAV chart at different ASST 0.00%↑ prices:

Twenty One

Tether, Bitfinex, Softbank and Jack Mallers join hands to form Twenty One Capital - which will be a bitcoin treasury company, then expanding into bitcoin native operations like education and branding (media to increase bitcoin adoption), and other bitcoin related financial services.

Bitcoin treasury operations

They intend to run the same playbook as Strategy MSTR 0.00%↑ - securitizing bitcoin - providing bitcoin exposure at different levels of ARR, volatility. Meaning that if bitcoin ARR, volatility is (60, 60), they intend to create bitcoin exposure products like equity which is levered to bitcoin (90, 90), convertible debt (30, 30), etc. At the start of Twenty One Capital $XXI, it will hold 42K BTC.

Here is how they reach 42K BTC:

Tether: 18,713

Bitfinex: 7,000

Softbank (through Tether): 10,500

BTC in-kind: 348

Tether's interim funding: 5,440 (for $462M)

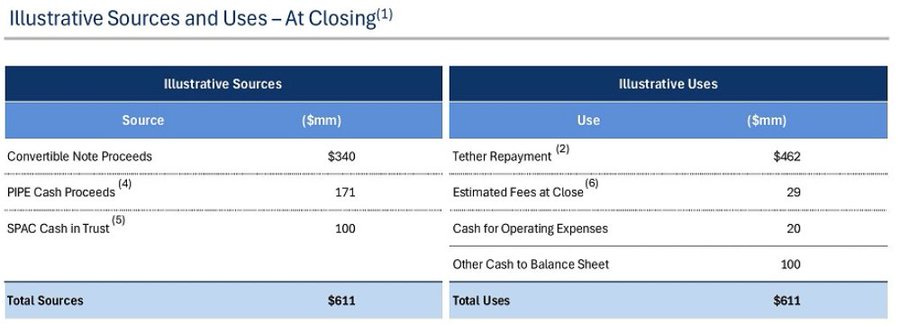

Zooming in on the interim funding part - Tether provided temporary financing to buy BTC quick (before closing of the transaction) of $462M. It will be repaid from the proceeds of convertible note (assuming only $385M is received and not the extra $100M option to acquire more - more on this later), PIPE cash proceeds, and the cash which is held in the SPAC. The extra cash will be used for fees, opex, and likely more BTC purchases. Refer to the image below:

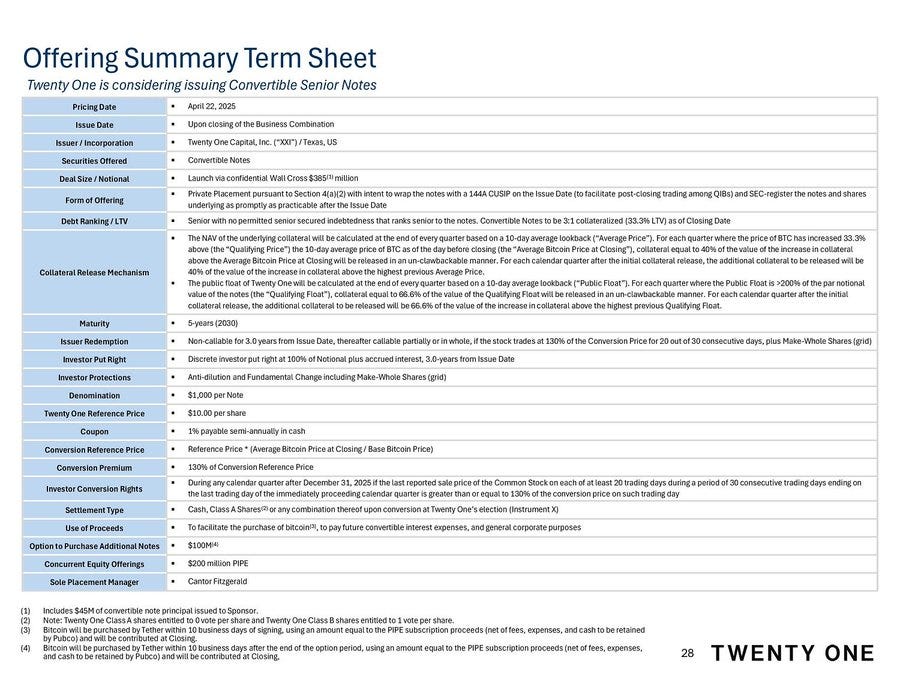

Convertible note offering: The proceeds from this will go to Tether for the interim funding provided to acquire BTC earlier than closing of the transaction.

Terms of the note:

Total size: $385M

Option to purchase extra: $100M

Reference $XXI price: $10

Conversion premium: 130% (thus conversion price of $13)

Coupon: 1% payable semi-annually

Maturity: 5 years (April 2030)

$XXI redemption: Callable after 3 years, if the stock trades at 130% premium to conversion price ($16.9) for 20 out of 30 consecutive days

Investor conversion right: After 31 Dec, 2025, if the stock trades at 130% premium to conversion price ($16.9) for 20 out of 30 consecutive days

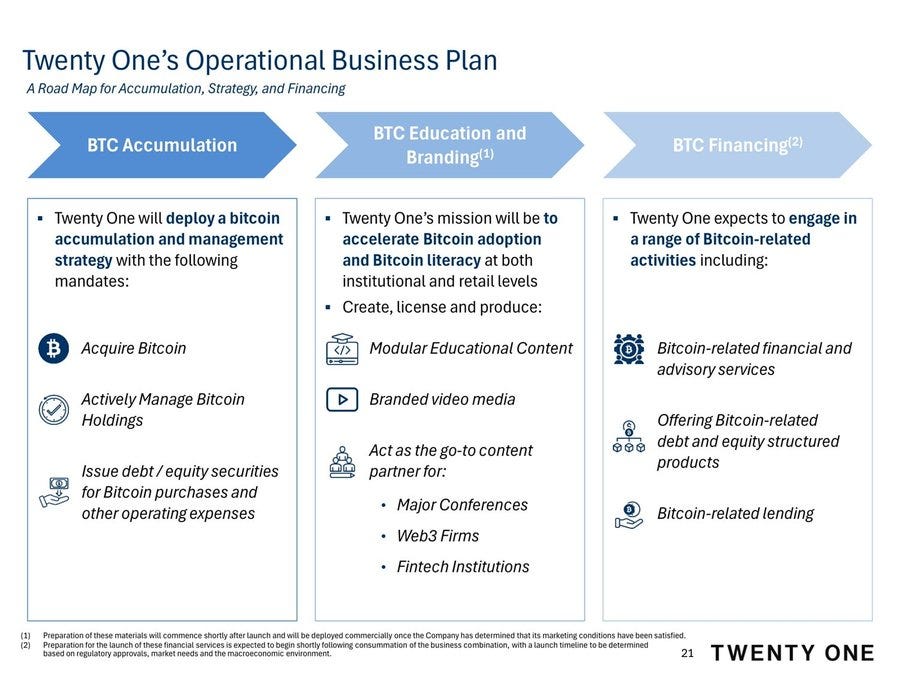

Company plan

Bitcoin treasury operations (securitizing bitcoin discussed earlier) will be the primary operations. Increase BTC per share most effectively through a combination of equity and debt.

Education and branding - Accelerate bitcoin adoption. Create education content for the same. Become to 'go-to' partner for bitcoin related content.

Bitcoin financing - This one is interesting and we should get info on what they plan to do here. What we know right now is that it includes advisory services, equity/debt offerings and lending.

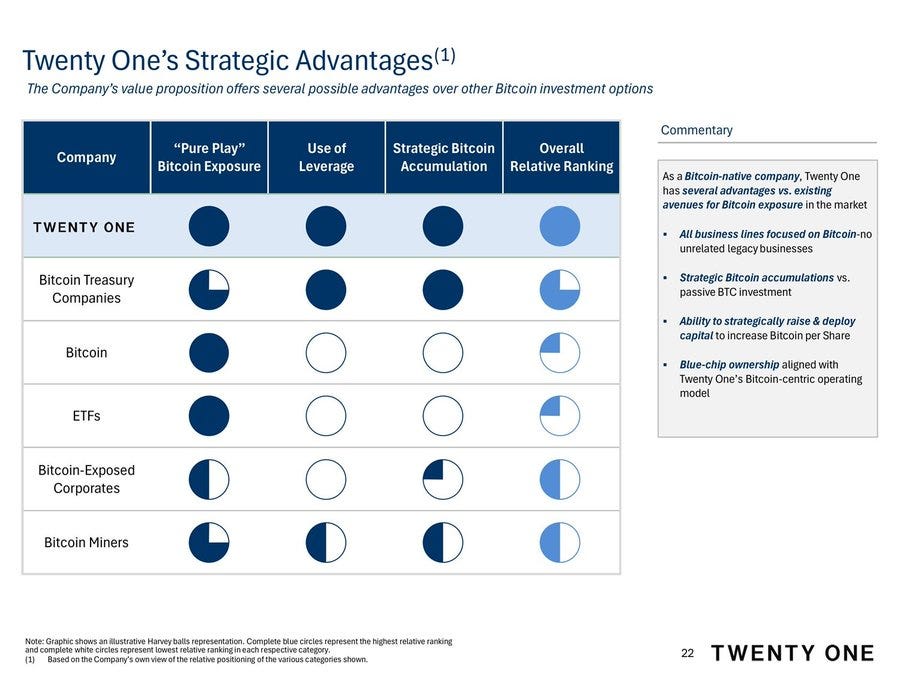

Value proposition

Ok so what is the value proposition - basically increasing bitcoin per share (accretive dilution). Generate a positive BTC yield.

One point here though: Comparing to other bitcoin treasury companies - On the operating side, it will be also be a bitcoin company. But this is not necessary an advantage. I mean just check Semler - it is a cash generating business which has OCF as % of sales ~30%. They use this to buy more bitcoin.

The competitive advantage is more from who is involved here - Tether, Bitfinex, Softbank, and Mallers. This is an experienced team and obviously these guys have a lot of money to deploy.

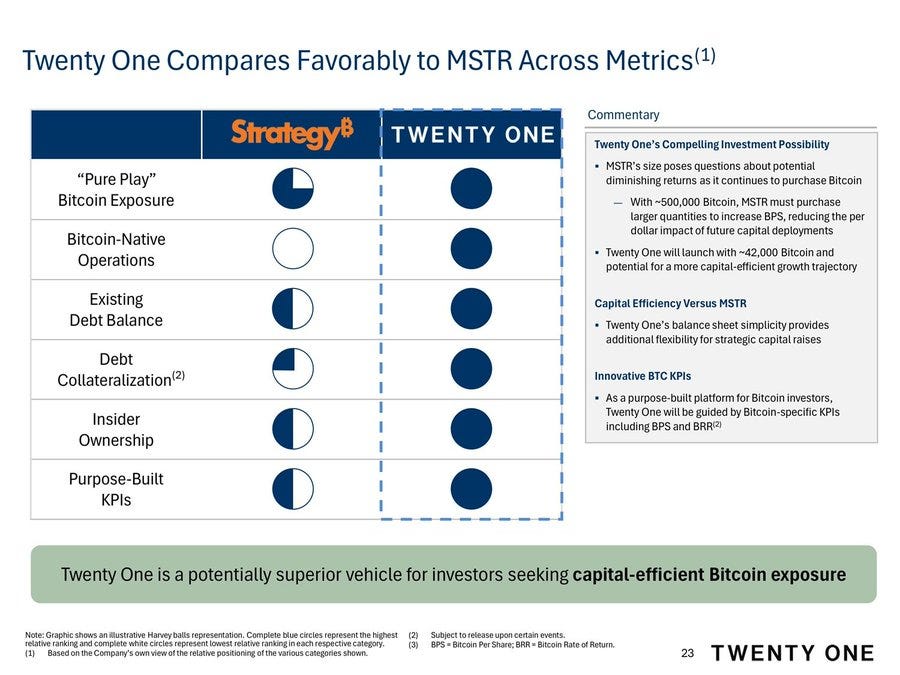

Lot of Strategy shareholders might might not like this slide. Rightfully so. Strategy was the first company to run the playbook - and now Twenty One shows this:

Yes, there are some solid advantages:

Size difference: Strategy already holds a large stack of ~530K BTC (>12x $XXI stack). So new purchases will be relatively smaller in size compared to existing stack, and thus the bitcoin yield could be lower.

Debt on balance sheet: $XXI currently has very low leverage ratio (BTC stack value/debt) as it is just starting out

The slide also states few advantages that I don't agree with:

Twenty One is a pure-play exposure (Strategy also has the operating software business). Not sure if this is actually an advantage though.

Insider ownership: Insiders will hold majority shares of $XXI. This is not the case with Saylor and Strategy. But, this does not mean that Saylor is not committed to running Strategy the best he can.

Also, public shareholders do not have any voting power in $XXI. But in Strategy it is close to 55%

The way I see it is that there is this is just a validation to Strategy playbook. This a playbook where competition is healthy - more treasury strategy companies usually translates to positive for bitcoin price.

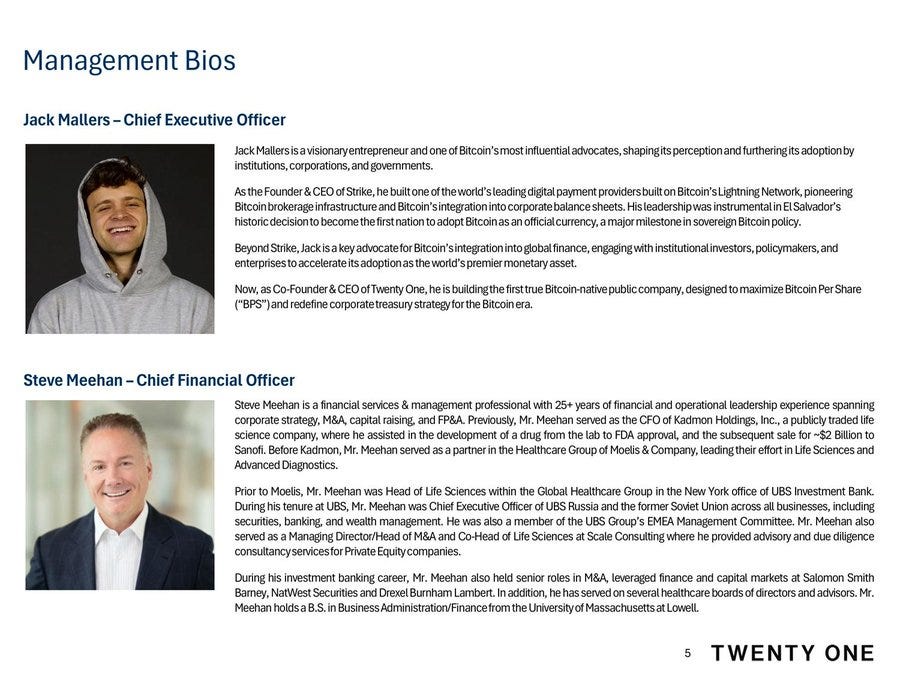

Management

Who's running the company? Jack Mallers:

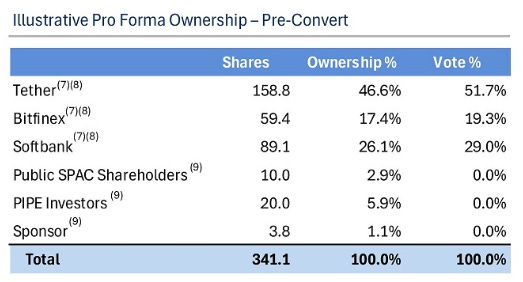

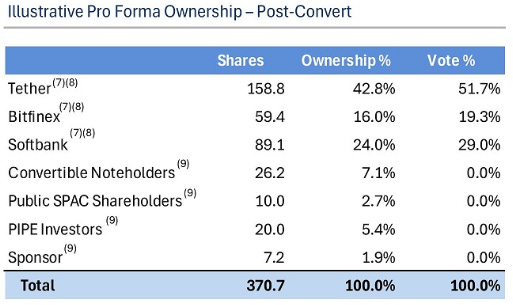

Ownership structure post SPAC merger

Tether and Bitfinex will hold majority shares (64%) and voting power (71%).

Also, the float will be very small - if PIPE investors and public SPAC shareholders are counted then it adds up 8.8% - that too with no voting power. This is a key risk.

And this ownership structure accounts for the convertible note holders:

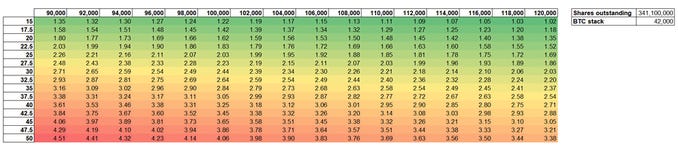

mNAV chart

This is basis shares outstanding (not fully diluted shares):